tax reduction strategies for high income earners australia

The higher your tax bracket the higher the benefits are of tax savings. Max Out Your Retirement Account.

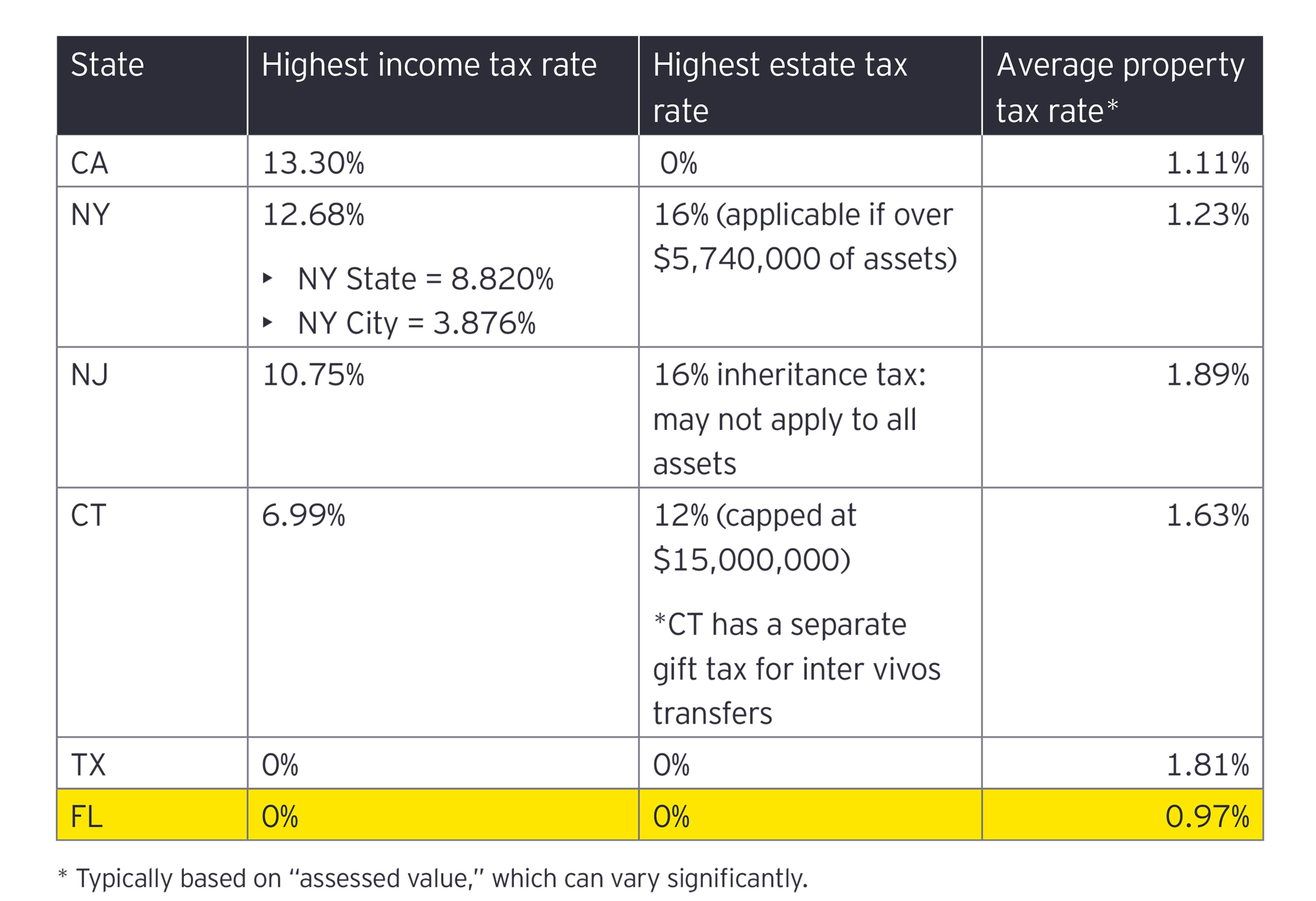

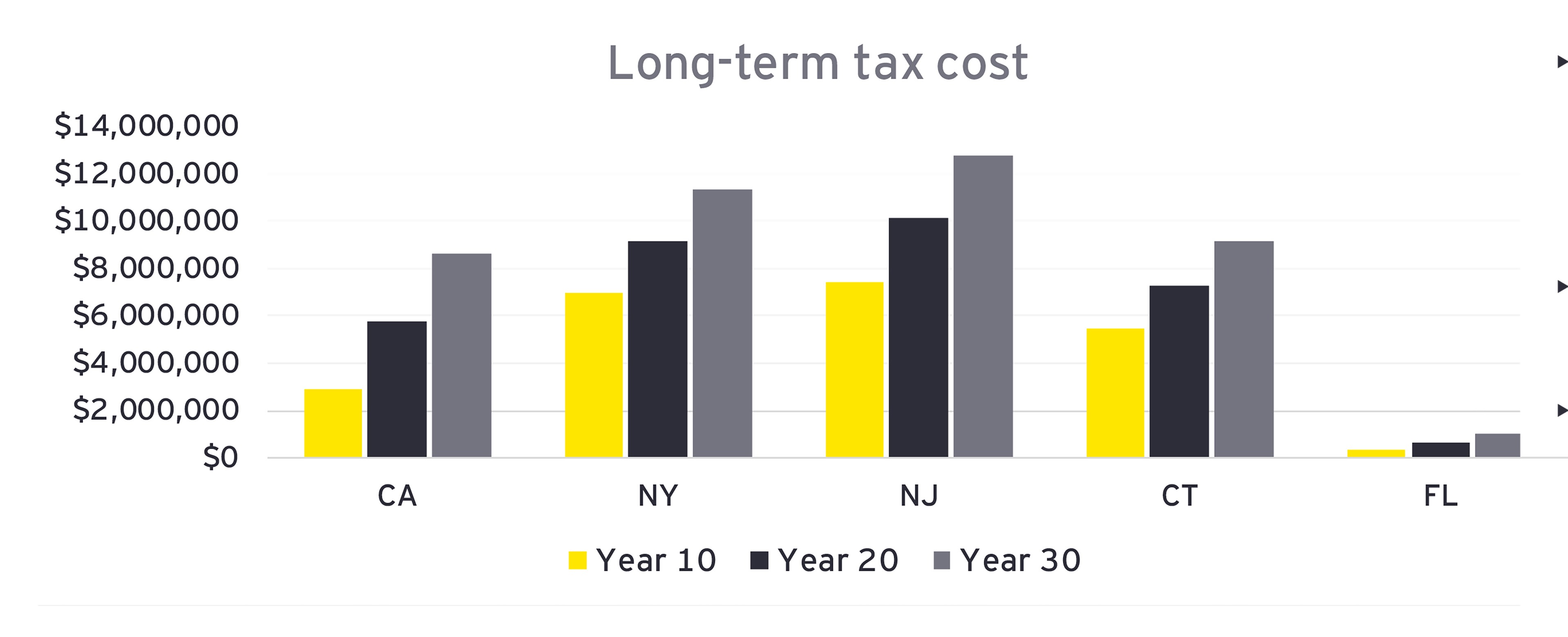

Tax Considerations When Moving To Florida Ey Us

TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA.

. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be. Creating retirement accounts is one of the great tax reduction strategies for high income earners. I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax.

Qualified Charitable Distributions QCD 4. For high-income earners this would lead to a significant tax reduction. The tax benefit of salary sacrifice super contributions is now more significant with the higher individual tax rates.

Spanish speaking therapist queens ny. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. Lizard live without food.

This is a tax-effective strategy because super contributions. How to Reduce Taxable Income. Its possible that you could.

So what are the top tax planning strategies for high income employees. Seriado netflix isabella nardoni. Tax strategies for high income earners australia.

As a refresher for 2021 FY the individual tax rates including medicare levy are. For taxable income levels between 180000 and 273000 the. The law permits you to deduct the amount you deposit into a tax-certified.

Wasabi high holborn opening hours. Republic act number 8432. Contribute to your Superannuation.

Tax Reduction Strategies For High Income Earners AustraliaQualified charitable distributions qcd 4. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. 6 Tax Strategies for High Net Worth Individuals.

This article lists seven strategies you should consider. Read on to learn more about tax reduction strategies for high income earners including the top 5 tips that are easiest to implement. However while there are no limits to the amount of salary you can sacrifice unless specified in your terms of.

Division 293 tax is an extra charge imposed on some of the super. Implementing tax minimisation strategies is crucial for high-income earners. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

Many Australian Tax Videos Are Discuss The Same BORING Strategies.

Roth Ira Rules Contribution Limits And How To Get Started The Motley Fool

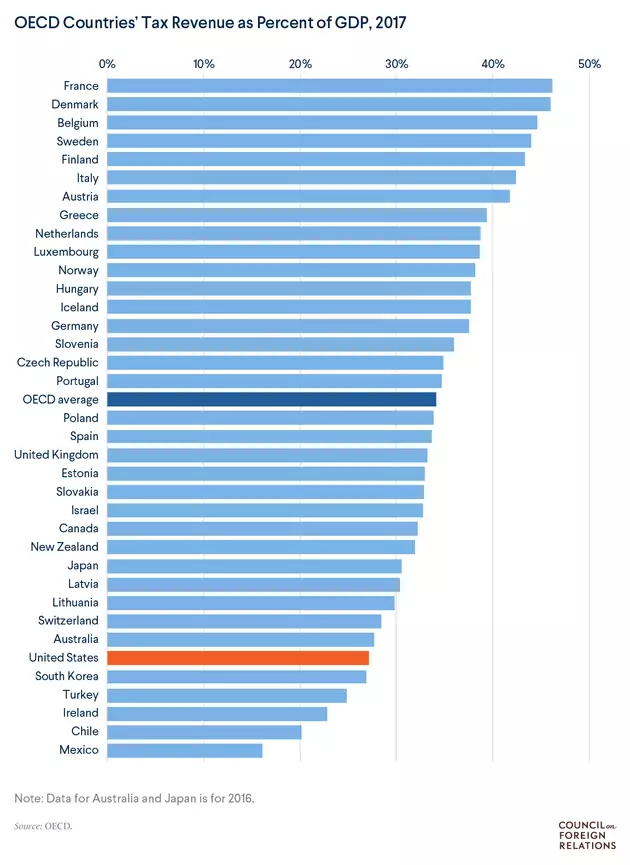

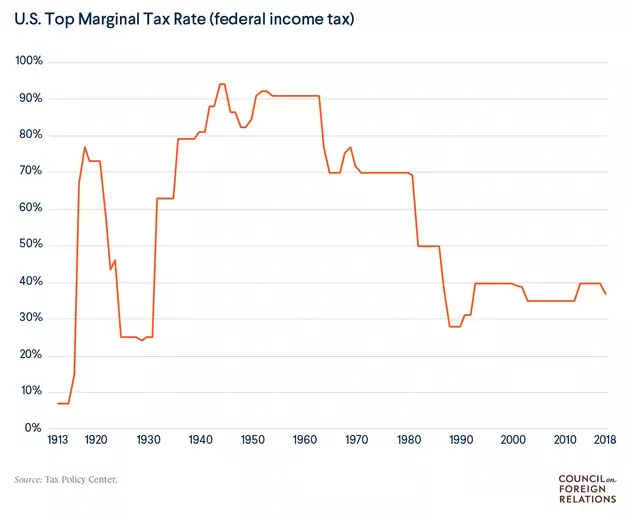

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

How Scandinavian Countries Pay For Their Government Spending

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

![]()

How Do High Income Earners Reduce Taxes In Australia

Tax Strategies For High Income Earners 2022 Youtube

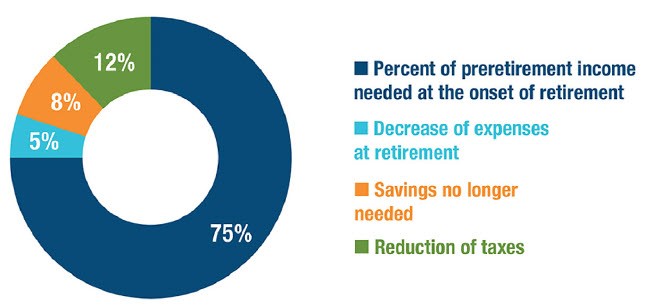

How To Determine The Amount Of Income You Will Need At Retirement T Rowe Price

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

Tax Minimisation Strategies For High Income Earners

How To Reduce Taxable Income For High Income Earners In 2021

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

Tax Reduction Strategies For High Income Earners 2022

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Is Australia S Tax And Welfare System Too Progressive Inside Story

Tax Considerations When Moving To Florida Ey Us

Tax Law In Context Part Ii Tax And Government In The 21st Century

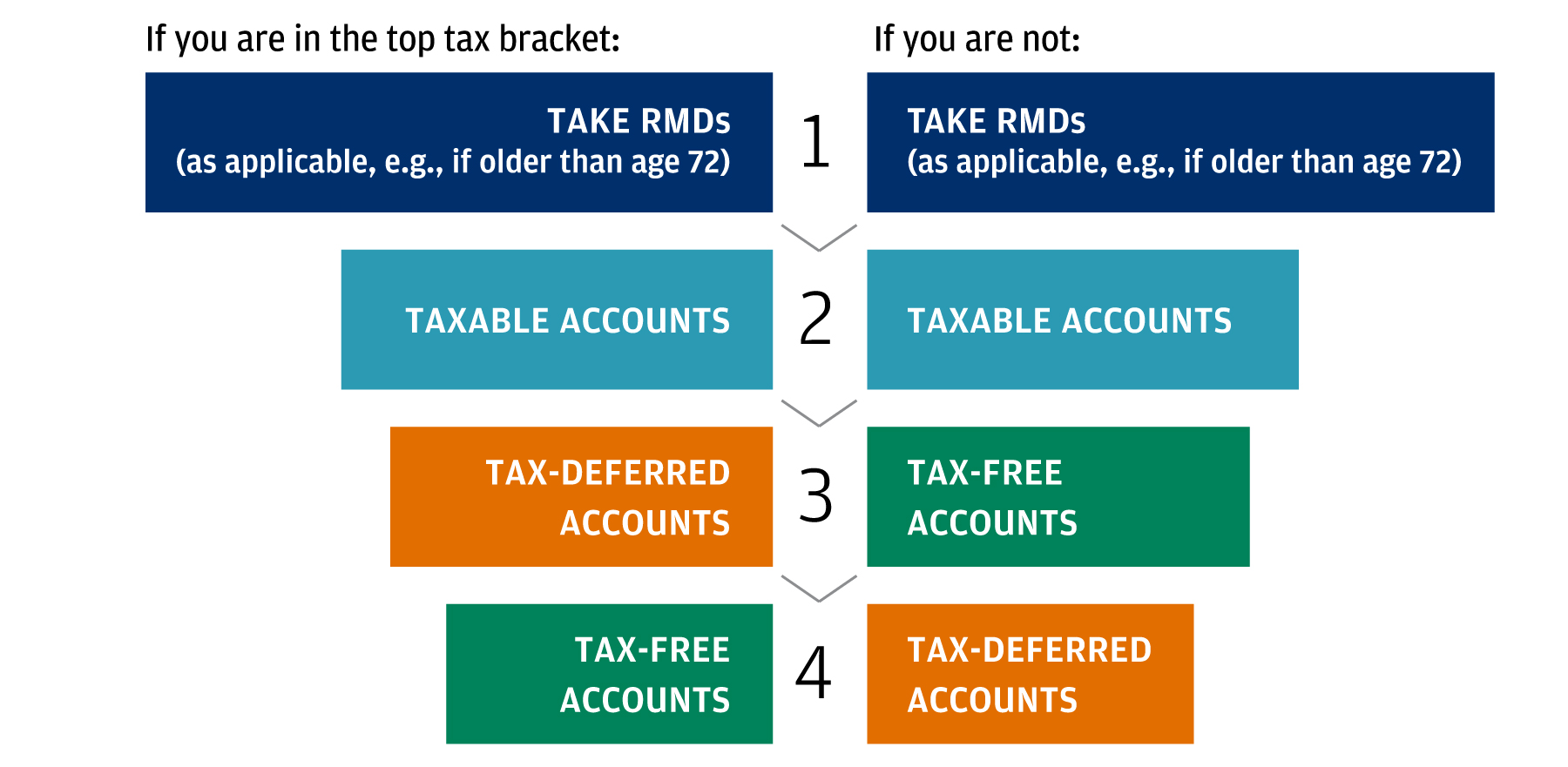

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank